Global GDP is likely to grow at a slower pace in the foreseeable future, based on projections and potential risks scenarios by the Economist Intelligence Unit (EIU), said Dr Simon Baptist, the global chief economist and managing director of EIU Asia.

He described this phenomenon as 'slowbalisation' (slower globalization) in his presentation of The World in 2020 at the SMU's Li Ka Shing Library in January.

"GDP will grow slightly at 2.4 percent this year, from 2.3 percent in 2019. The world economy is interconnected and extremely integrated, but the integration process will be a lot slower with more potential barriers when it comes to moving people, capital, services and goods," he noted. He added that the current low interest environment and elevated national debt levels have also tempered the ability of governments to employ monetary or fiscal tools as economic levers.

While there has been an easing in US-China trade tensions with the signing of the Phase One deal and the stepdown in tariffs, fundamental disagreements over the role of technology and access to sensitive information and sectors will be harder to resolve and will be protracted for a decade or more.

"It's not a real (trade) deal but one that stops things from getting worse by not following through with threats," he said. "Technology, on the other hand, is a big driver of geopolitical influence with less room for compromise," he said. He added that the biggest risk going forward would be that of a split in the global trading system, with companies forced to pick sides in the tussle over global influence between the two rival superpowers.

"We will likely see more flux in geopolitics with the US putting pressure on the traditional alliance system," he said. He gave the example of the role of the US in ending the World Trade Organisation's (WTO) arbitration powers, which has left many US allies uncomfortable with the stance and reliability of America as a partner.

Systemic Threats

Any expanded fallout may include spillovers into a currency war or the financial spheres where the US might impose financial sanctions in US-dollar denominated foreign investment and make it onerous for Chinese investments in the US. Meanwhile, the Chinese might resort to restrictive import measures such as prolonged customs inspections, delays due to health regulations as well as blacklisting of American companies. Other potential risks to the global system include a bursting of the credit bubble in China, conflict on the Korean peninsula or in the South China Sea as well as major cyberattacks.

In the longer run, the risks over the next decade from climate change such as floods and natural disasters will see cities in Southeast and South Asia such as Bangkok, Jakarta, Manila and Dhaka becoming more vulnerable due to poor infrastructure and lack of preparedness. This could lower global GDP by as much as 1 percent, according to EIU.

As for oil markets, Dr Baptist noted that responses to the attacks on Saudi facilities by Iranian proxies and the US assassination of Iranian general Qassem Soleimani have been relatively low-key. That is because fears of extreme price swings are now less pronounced reflecting lower and more elastic global demand against the backdrop of lower production costs of traditional oil producers and the cushion of US shale on world supply.

Growth Hotspots

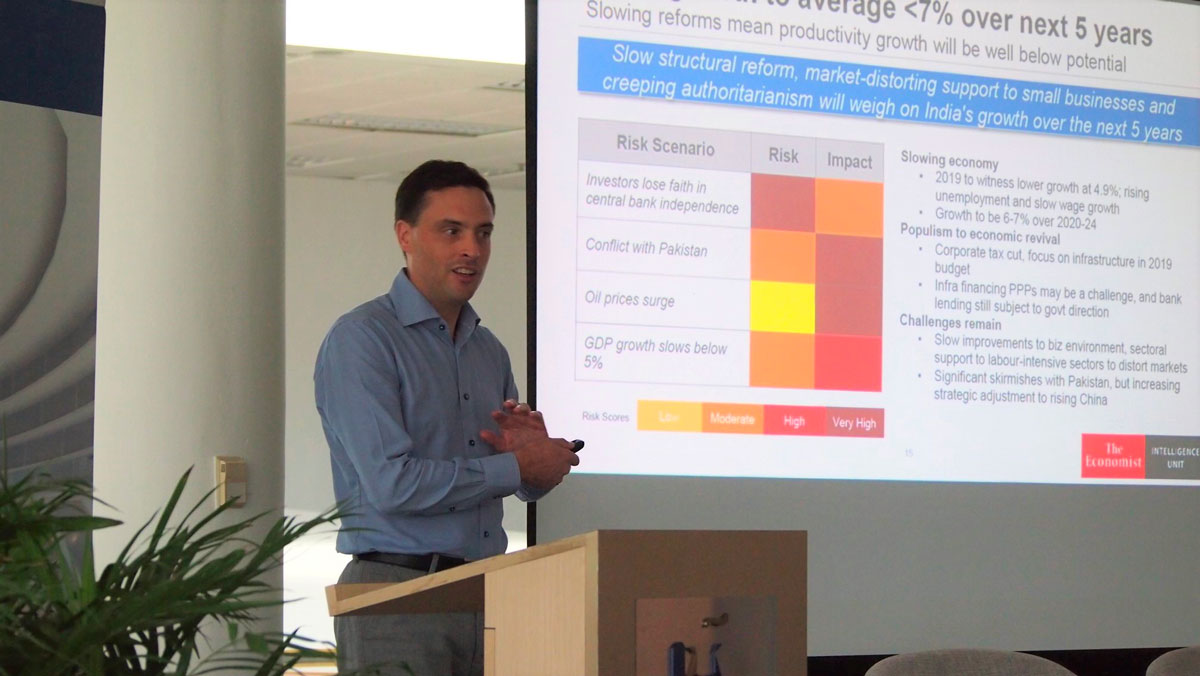

According to EIU, India and China will continue to lead the rankings with growth rates at 6.3 percent and 6.0 percent respectively in 2020 with Southeast Asia coming in again at third spot at 4.3 percent. Vietnam, Cambodia, Myanmar and the Philippines are expected to be among the top 10 fastest growth hotspots.

Vietnam, Malaysia and Thailand will be trade war beneficiaries in the coming months from an influx of investments that will add to production capacities in sectors such as electronics and automotive. Meanwhile, Cambodia, Myanmar and Laos will see support from the infusion of Chinese capital investments. Countries that will see growth driven by private consumption will be Bangladesh, Vietnam, India and the Philippines, he said.

Singapore will see a slight uptick from the previous year due to the pause in trade friction and the trickle-down impact from supply chain relocations to Southeast Asia as well as short-term gains from multinationals relocating from Hong Kong, said Dr Baptist.

The Singapore dilemma

Following the presentation, Professor Gerry George, Dean of the Lee Kong Chian School of Business, moderated a lively panel discussion which included SMU Associate Professor of Economics, Tan Swee Liang and EIU Asia analyst, Waqas Adenwala.

Prof George began by asking what measures Singapore could put in place to sustain longer-term competitiveness and strike a balance between declining population growth and immigration while managing local attitudes towards structural displacement in employment and foreign talent in the workforce.

Professor Tan noted that with restraints to monetary policies in the face of low interest rates, there are limits to what the government can do in terms of capital accumulation and labour force growth. Hence, the focus has to be on how to develop longer-term potential and productivity in the workforce. "That is where technology plays a role in creating innovation and greater efficiencies," she said.

Mr Adenwala concurred, noting that given the limitations of demographics and land expansion through reclamation, Singapore will have to go deeper into services, finance, shipping and digitalisation to have a sustainable model.

Noting the savings-investments gap despite persistent trade surpluses, Professor Tan observed, "Like other parts of East Asia, there is a lack of safety net and hence the confidence to consume."

Expanding on this, Dr Baptist pointed to China, where less than half of the GDP is directed into private consumption compared to 80 percent in Australia. "I would suggest a more systematic provision of public healthcare and pension rather than, for example, periodic Pioneer and Merdeka generation giveaways which is not predictable when preparing for retirement. This will reduce the levels of precautionary savings and hence encourage higher consumption."

Professor George challenged this though, pointing out that the welfare state model is no longer popular. "Isn't the welfare state broken?" he asked the panelists.

Mr Adenwala responded that Singapore's small size made it an exception and added that more could be done to tweak healthcare services, which is gravitating towards the more expensive American model, which relies more on private insurance compared to the United Kingdom which is less costly per person with better outcomes than the US.

On the issue of jobs of the future, Dr Baptist said it would mean developing skillsets that are not easily replaced by automation such as in "managing people, the ability to work in complex teams, and in design and creative jobs where machines do not have the skillsets."

Sector-wise, the panellists pointed to niche areas in pharmaceuticals, services for the elderly and business opportunities from climate change such as renewable energy and expertise in infrastructure building as capital stocks and equipment would need replacing sooner in future due to weather, floods and other natural disasters.

At the end of the event, Professor George thanked the panellists for their insightful viewpoints which he hoped were instructive for SMU students in their research and future job searches. Twenty members of the audience also received a copy of the EIU 2020 Report.

The event was organised by SMU Libraries and EIU and was attended by more than 80 people, comprising faculty and undergraduates.