Stories from the LKCSB Community

How Two MQF Students Leveraged Their School Projects To Secure Their Jobs

From in-class theory to real-world practice, this master’s programme will equip grads with skillsets needed to navigate the algorithm-ridden world of banking and finance.

Spotting growth opportunities in uncertain times

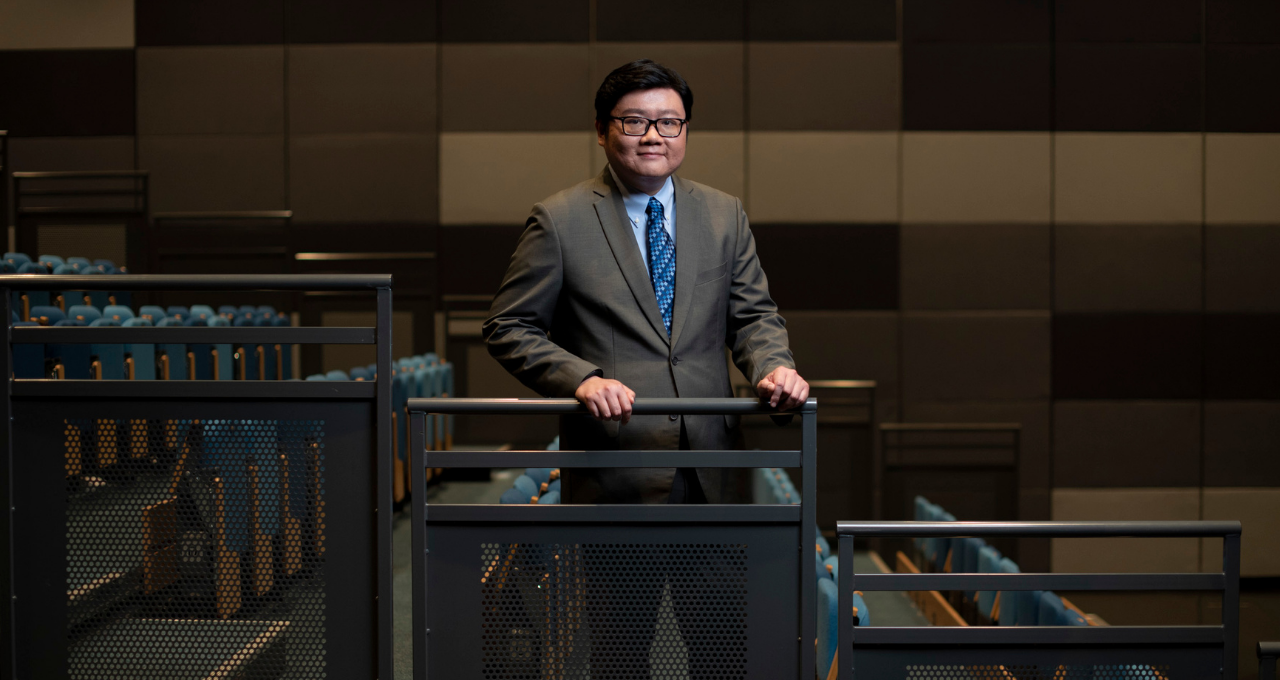

Although the popular Western interpretation of the Chinese characters for crisis — 危机 — as “danger” and “opportunity” has been found by linguists to be inaccurate, it nevertheless encapsulates the idea that opportunities may arise in times of adversity. We speak with SMU Associate Professor in Quantitative Finance (Practice) Tee Chyng Wen about industries that may benefit from global instability, and top areas where opportunities may arise during adversity.

The current state of the Quant job market

Quants have long been regarded as "the rocket scientists of finance". Whizzes in employing a blend of mathematical modelling, computing skills and finance, experts in quantitative finance (QF) are usually highly sought after by financial firms and institutions to price and trade securities.

Forging his own path through the MQF programme

Growing up in a small town on the outskirts of Mumbai, India, Anirudh Somani’s path in life could have been pretty clear-cut — had he chosen to follow it. His parents owned a textile manufacturing business, and they hoped he would follow their footsteps after performing well in school, so as to eventually take over the business.

Making the most of a Global Education

The field of quantitative finance is often seen as being very data-driven, taming risks and making a killing with a plethora of financial instruments. But besides acing proprietary trading or mastering sophisticated risk management strategies, the global financial industry is always on the lookout for quant professionals with a distinctly international perspective.

Quantitative Finance: Balancing Theory, Practice and Innovation

In an era of intense economic and political volatility, it appears nothing short of clairvoyant abilities are required to make sense of current financial markets. Thankfully for the less psychically endowed, quantitative finance lies at the intersection of finance, statistics, applied mathematics and computing.