In a world where technology seems to be constantly evolving, it's more important than ever for wealth managers to stay ahead of the curve. But even amid the change, some things remain immutable, with one of the constants being the importance of ESG investing.

ESG is a popular acronym that stands for environmental, social and governance factors, which can be incorporated into financial decisions to create a more sustainable and responsible approach to investing. While sustainable investing may sound like a new concept, it has been around for a while – and has recently gained greater traction as investors become more aware of the need to consider all aspects of a company when making investment decisions.

Designed to deepen aspiring and seasoned wealth managers' skills, knowledge, and expertise, the SMU Master of Science in Wealth Management (MWM) curriculum provides ample opportunities for students to meet their peers and industry captains in seminars, talks, internships and site visits.

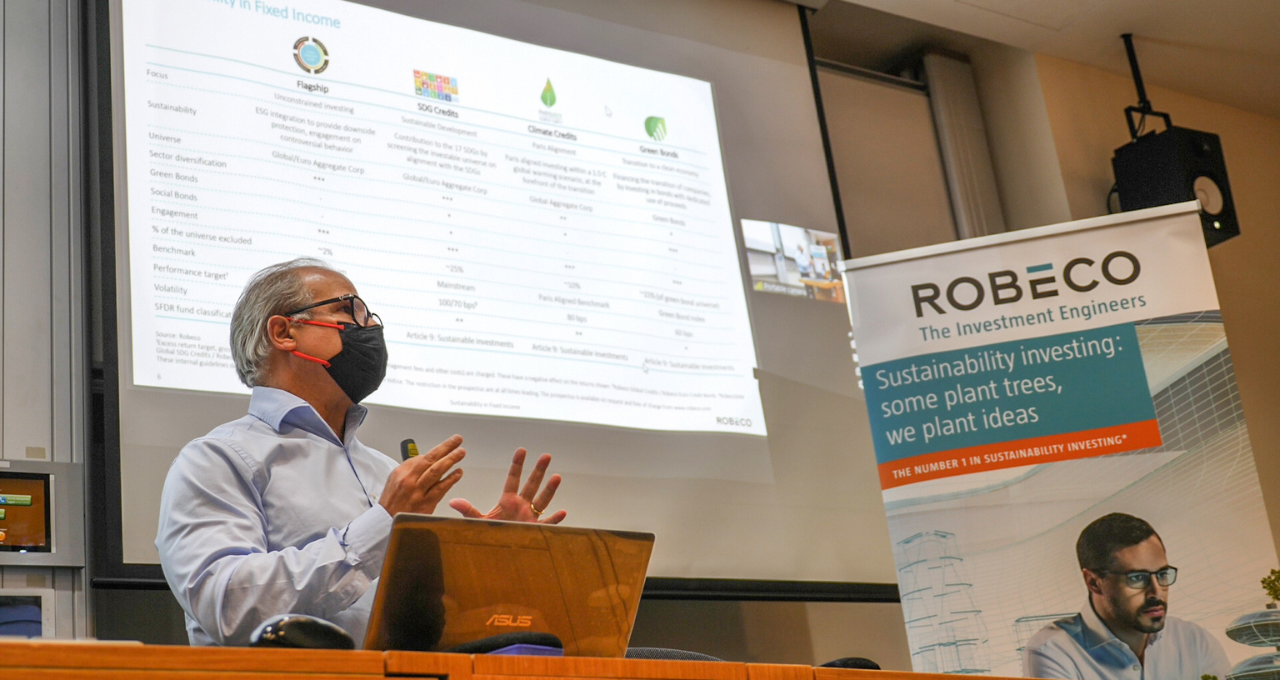

First held virtually in 2021, the annual lecture by asset management firm Robeco on sustainable investing was recently conducted in person at SMU LKCSB for MWM students.

“It’s important for the asset management industry to create something positive in terms of wealth preservation and use the opportunity to generate societal benefits and use ESG data to steer investment decisions,” says Nayan Patel, CEO of Robeco Singapore.

This year’s event showcased Robeco’s insights on sustainable investing trends and methodologies, followed by students' hands-on research and discussion activities to analyse case studies.

By delving into the success stories of applying sustainability techniques to real-life situations, Robeco unveiled how such principles can be used to spot trends and avoid problems. The session culminated in a mini-case competition to spur in-depth problem solving, with students presenting ESG strategies for business scenarios.

Why is sustainable investing relevant right now?

There is much buzz surrounding sustainable investing—but what exactly is it? And why should investors care?

Simply put, sustainable investing (SI) is an investment strategy that seeks to generate financial returns while also promoting environmental or social good. In other words, sustainable investors aim to do well by doing good.

According to Robeco’s “investment engineers”, demand for resources has spiked since 2000, a trend that is likely to continue until 2030. Factors such as demographic change, shifting consumer preferences, demand from emerging economies, energy and resource insecurity and environmental pressures are just some of the pressing sustainability challenges faced by the world — exacerbated by crises such as the Russia-Ukraine war and Covid-19.

Sustainable investing offers the potential to generate significant long-term financial returns while also positively impacting environmental and social issues. Investors have started to recognise that companies with strong ESG credentials tend to be better run, more innovative, and manage risks more effectively – all attributes that lead to improved financial performance over the long term. A 2020 study by Gartner found that 85 per cent of investors considered ESG factors in their investments. Significantly, Robeco has noted that climate change will be central or significant for almost nine out of 10 investors over the next two years.

A win-win situation

A challenge faced by sustainable businesses is the concept of double materiality, which refers to the idea that environmental and social factors should be considered just as important as financial factors when making investment decisions. However, the additional investments required to achieve a triple bottom line may just be worthwhile, as research shows that companies with strong sustainability practices tend to be more profitable and have lower stock volatility than those without them.

The goal of sustainable investing is to identify companies that are profitable and environmentally and socially responsible. This can be done by looking at a company's environmental performance, social impact, governance, and human rights records. Further, there are different ways to translate sustainability data into investment frameworks — after all, it’s not just about the availability of the data, it’s about understanding it.

For a start, asset managers should examine environmental trends and hotspots on a global scale to identify companies and countries that are most exposed to environmental risks. Another is to look at a company's environmental footprint to gauge its level of responsibility and potential liability. And finally, one can examine a company's social and environmental performance through the company’s SI profile.

Walk the talk

When it comes to fixed income — a type of debt security in which the issuer pays a fixed rate of interest over the life of the security, such as bonds — ESG integration and adoption requires a well-structured and disciplined approach.

For example, Robeco’s SDG Credit strategies are an investing tool to help build wealth and positively contribute to Sustainable Development Goals (SGDs). The SDGs are a set of 17 goals determined by the United Nations to end all forms of poverty, inequalities, and climate change.

During fundamental credit analysis, ESG insights are employed to better assess downside risks in credits by identifying key ESG factors, analysing the firm’s exposure to them, and the impact of the ESG factors on its F-score (a measure of the strength of a company's financial statement).

The SDGs play a pivotal role in helping investors avoid “losers” such as companies involved in oil, nuclear or coal mining activities, or producers of unhealthy foods, zone in on firms that are part of SI regulation, and have a plan for positive impact.

With regulatory bodies such as the Monetary Authority of Singapore building capabilities to incorporate ESG considerations into financial decision-making, and a clear demand from investors to address ESG goals via their wealth management portfolios, sustainable investing is here to stay for the long haul. By incorporating sustainable investing into their practice, wealth managers can help clients achieve their financial goals while also positively impacting the world.

Speak to our Admissions Advisors

Lee Kong Chian School of Business

Postgraduate Admissions

Singapore Management University,

SMU Administration Building

81 Victoria Street, Singapore 188065

Tel: +65 6828 0882

Join us at the upcoming events

Ofukacho, 1−1 ヨドバシ梅田タワ

Osaka, Kita Ward, 〒530-0011, Japan

Kyobashi, 1 Chome−3−5 三井ガーデンホテル 1F

Chuo City, Tokyo, 〒104-0031, Japan

1 Raffles Drive, Makati Avenue, 1224, Makati City