How family firms can leverage firm-specific advantages even in an era of macroeconomic shocks

Students who do not have a background in wealth management are to do internships. We will assist students as far as possible to secure placements.

It is envisaged that internships will incorporate some or all of the following activities:

Companies that have hired our students include ABN AMRO, APS Asset Management, Bank Julius Bär, Bank of Singapore, BNP Paribas Private Bank, Capital International, Citi Private Bank, DBS, Deutsche Bank Private Wealth Management, GIC, HSBC Private Bank, Lion Capital, Morgan Stanley, NTUC Income, OCBC Bank, Pioneer Investment Management, Standard Chartered Bank, State Street Global Advisors, Temasek, UBS AG, UOB Asset Management and United Overseas Bank.

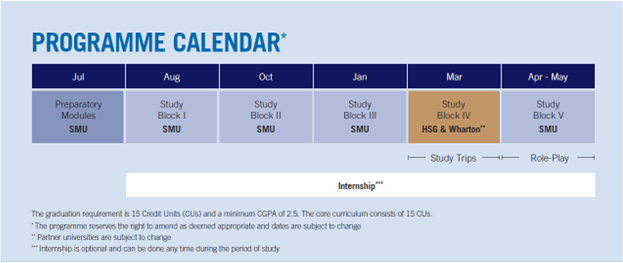

The graduation requirement is 15 Credit Units (CUs) and a minimum CGPA of 2.5. The core curriculum consists of 15 CUs.

* The programme reserves the right to amend as deemed appropriate and dates are subject to change

** Partner universities are subject to change

*** Internship is optional and can be done any time during the period of study

*The programme reserves the right to amend as deemed appropriate and dates may subject to change.

Ph.D (Finance), University of Michigan

Academic Director, MSc in Wealth Management Programme

Associate Professor of Finance (Education)

Lee Kong Chian School of Business

Be a master of wealth management. Enrol in the MSc in Wealth Management

Wealth management is both an art and science. It is about managing investment returns and risks for both individuals and institutional clients. It is about wealth growth, wealth preservation, and wealth transfer.

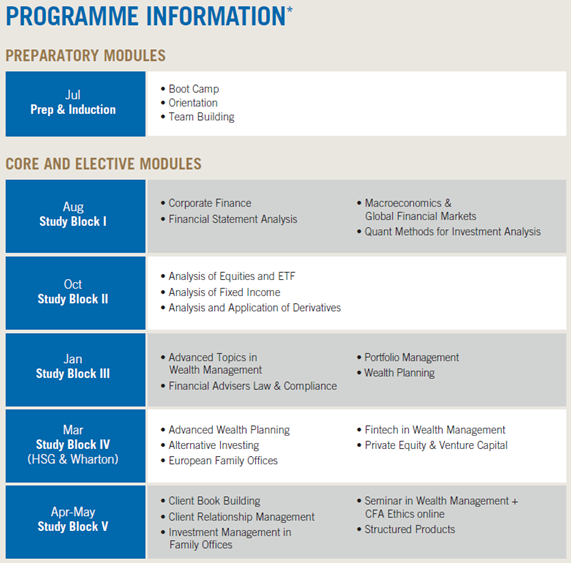

The MWM programme covers the whole value chain of processes, products and services related to wealth management from a practical perspective. Participants learn about asset management as well as investment advisory. The programme is recognised as a graduate programme associated with the CFA Institute and CAIA. Moreover, the required examinations and competencies for Singapore’s private banking industry has been recently incorporated to empower an individual to be completely “job ready” for this exciting industry.

The curriculum is designed collectively by both academic professors and industry professionals, including private bankers, asset managers, investment analysts and consultants. It is regularly reviewed to reflect industry developments. There is a careful balance between the theory and practice of wealth management.

For the selected group who will undergo this comprehensive programme, we promise an enriching experience. The array of learning activities includes seminars, assignments, projects, field trips, industry talks, case studies and interactions with industry professionals. The overseas segments include a unique experience in eminent universities in Switzerland and USA.

Participants will interact with wealth management professionals from three continents, i.e. Asia, Europe and North America. There will be ample opportunities for exposure and immersion in the real world of global investing.

The MWM programme is the progressive way to stay at the frontier of global investing. Join us if you have the passion for a career in wealth management.

The Master of Science in Wealth Management (MWM) is ranked first in Asia and third in the world by Financial Times in its 2020 Masters in Finance post-experience ranking. It incorporates a unique overseas experience in Switzerland and United States where you learn from top practitioners and academics, and be hosted by leading financial institutions who support this global programme.

MWM is a 12-month full-time programme designed to meet the needs of both aspiring and seasoned wealth managers who wish to deepen their skills, knowledge and expertise. The modular structure allows professionals to pursue a Master’s degree while working; and those without wealth management experience can embark on an internship to enhance their employability.The programme’s curriculum has also incorporated the relevant examination and certification for private banking.

Upon completion of MWM, the individual will receive a Master’s degree by SMU. All this within just 12 months across three continents.

Designed in close consultation with the wealth management industry, the curriculum is regularly reviewed to reflect industry developments. There is a careful balance between the theory and practice of wealth management. The programme is taught by experienced faculty and competent industry professionals who share their knowledge and skills generously with the participants. Participants will have ample opportunities to meet their peers and industry captains in seminars, talks, internships and site visits. Participants without wealth management experience are encouraged to take part in the internship programme to gain relevant experience and to enhance their employability.

The programme is also recognised as a partner of the CFA Institute.